There is a hidden underworld of the global financial system, where fortunes are earned and lost in the blink of an eye, that is shielded from the attention of authorities and the general public. HLK Group Pty Ltd., an Australian-based entity, has emerged as a pivotal player in this confidential arena, leveraging its license from the Australian Securities and Investments Commission (ASIC) to provide legal cover for forex brokers and financial companies.

Our team has been researching and investigating to reveal the shady relationship between HLK Group and forex brokers around Asia.

Behind this seemingly legitimate facade lies a web of deception that has ensnared unsuspecting investors, leaving them grappling with the aftermath of fraudulent schemes and scams. The question that looms large is whether HLK Group Pty Ltd. is a willing accomplice or an unwitting pawn in this high-stakes game.

According to the online resources, HLK Group identifies their services as “The Corporate Authorized Representative of HLK Group offers a host of managed discretionary Account services which can be customized to suit clients’ needs.”.

The License: A Double-Edged Sword

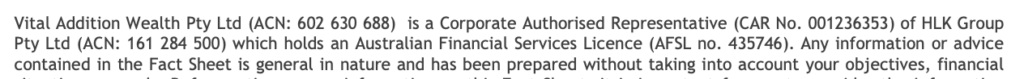

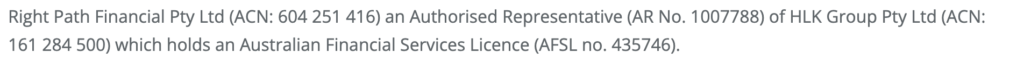

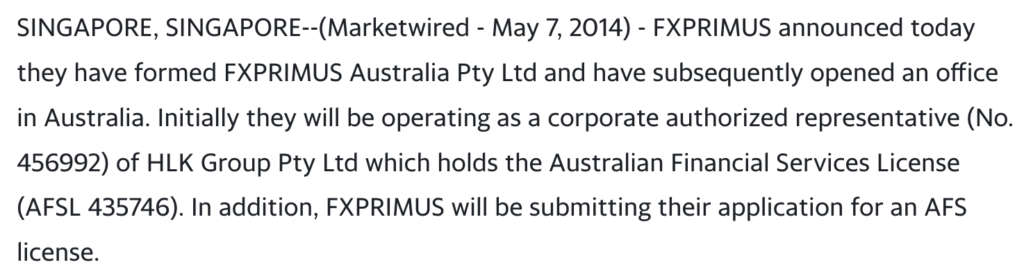

HLK Group’s ASIC license number (435746), grants it the authority to operate as a financial services provider. A quick online search on this number shows a huge number of companies that operate under the same license. However, this authority has been wielded not only for noble financial endeavors but also for providing a cloak of legitimacy to a slew of offshore brokers and white-label financial companies.

Under the protective umbrella of HLK Group’s AFS licenses, a multitude of companies have flourished, some of which have been embroiled in dubious activities and fraudulent practices. Investors in Asia have found themselves ensnared in these web-based traps, their hard-earned money vanishing into the abyss.

HLK Group and The Scamming Brokers

HLK Group and AximTrade

One of the most notorious entities operating under the shelter of HLK Group as an AR is AximTrade. This forex broker, presenting itself as a legitimate player in the financial markets, has allegedly left a trail of disgruntled clients across Asia. Their modus operandi involves promising investors hefty returns while concealing a tangled web of deceit beneath the surface.

AximTrade’s affiliation with HLK Group raises significant questions about the extent to which this regulatory cover is being exploited. Reports of investor complaints and allegations of fraud have cast a dark shadow over AximTrade’s operations, leaving many wondering how a company with such a dubious reputation continues to thrive.

GrapheneFx

Similar cases have been reported in the last two years with other brokers in Asia. Some of these companies include GrapheneFx, which has been reported by many customers as a scam, according to (Trustpilot).

Hong Kong Selead Group Pty Ltd

As we investigated more, the trail of deception led us to Hong Kong Selead Group Pty Ltd, a seemingly innocuous entity that first appeared on the radar in August 2021.

Our investigation has identified the individuals who appear to be the original architects of this criminal organization, as well as a Chinese national residing in Australia. Hong Kong Selead Group Pty Ltd, an Australian Financial Services Authorized Representative, commenced operations on August 19, 2021, with its base at NSW, Australia. Its identifying numbers include ACN 652 866 307 and ABN 93 652 866 307. Ruizhe Zhou serves as Director and Secretary, with an appointment date of August 16, 2021, as per ASIC Document No. 2ELL77293. The company has been involved in several reported scams, according to the trading community of Forex Peace Army.

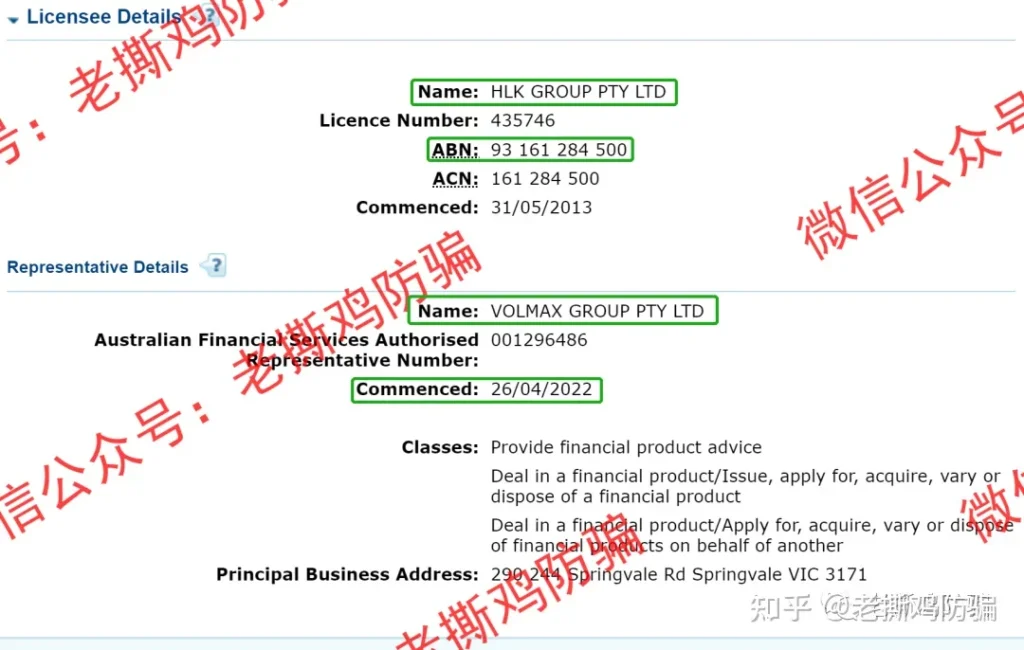

Another case is Volmax, which has been covered in an article that highlights its relationship with HLK Group. Check out the full article: The Case of Volmax.

The topic of why HLK Group appears to have continued to provide support to various scammer platforms with no apparent ramifications to its license is relevant. It hints at a complicated interplay within the regulatory framework and raises questions regarding the legitimacy of its role as an authorized representative (AR).

It is critical to assess if HLK Group was fully aware of the actions of the companies permitted under its AR license, particularly when they are involved in fraudulent operations. The assumption that this license is essentially a sham to provide offshore brokers and financial firms with a veneer of legality is alarming.

The fact that HLK Group has escaped prosecution despite these related entities reportedly engaging in fraudulent operations is cause for concern. It calls into question the efficiency of regulatory monitoring as well as the responsibilities of ARs such as HLK Group to ensure that their authorized firms comply with ethical and legal standards.

The larger issue here is the need for increased regulatory oversight and responsibility in the financial industry. Authorities must thoroughly investigate these allegations and, if required, take decisive action to preserve investors and the financial sector’s integrity. Your complaints highlight the need for openness and ethical behavior in the financial services business.

The Victims and Their Ordeal

Putting this information together with the financial service providers operating under their license number, we can have a clear view of HLK Group’s services.

For the unsuspecting investors who have fallen victim to these scams, the consequences are dire. What initially appeared to be promising investment opportunities have morphed into nightmarish experiences of financial loss, despair, and frustration. These victims, often hailing from Asian countries, have been left in the lurch with little recourse for justice.

HLK Group: A Call for Scrutiny

As the spotlight intensifies on the actions of HLK Group, there is a pressing need for regulatory bodies and authorities to investigate the extent of its involvement in these dubious financial operations. While HLK Group may claim to be a legitimate financial services provider, its role in providing cover for potentially fraudulent entities cannot be overlooked.

The lack of official employees within HLK Group raises red flags, further emphasizing the need for a thorough examination of its operations. The fact that this entity serves as a conduit for offshore brokers and financial companies operating with questionable intentions underscores the urgency of the situation.

The Directors of HLK Group: A Closer Look

Central to this intricate web of intrigue are the directors of HLK Group, who play a pivotal role in its operations. Neil Shellshear, a key figure in the organization, is no stranger to the financial world. Currently serving as a Director at HLK Group, he has also been associated with other companies, including Belatan Group, a small business consulting firm. Another director, Jason Holdsworth, holds multiple roles, including being the director of Aleda Capital. A quick look at LinkedIn shows that all these companies have no employees besides those directors. How come?

However, peering beyond these corporate titles reveals a startling reality: These three entities operate without a single official employee on their rosters. They are, in essence, shell companies intricately designed to offer a veneer of legitimacy to offshore brokers and white-label financial enterprises.

Notably, a press release in August 2017 by Investors Daily brought to light a collaboration between directors Jason Holdsworth and Neil Shellshear to introduce an automated investment platform featuring five managed discretionary accounts (MDAs). The platform’s primary objective is to revolutionize the onboarding process for clients, sparing them the arduous journey of enduring lengthy meetings with traditional wealth advisers. It champions accessibility, catering to a diverse array of investors, with a particular focus on those aged between 35 and 55.

Intriguingly, a visit to the Australian Securities and Investments Commission (ASIC) website unveils a crucial detail: HLK Group possesses License No. 435746. As we learn more about the situation, the Australian Financial Services License (AFSL) data confirms that HLK Group has expanded its reach to include a wide range of businesses that are all operating under the protection of this license.

Unmasking the Enablers

The importance of facilitators like HLK Group in the ever-changing world of global finance cannot be overstated. These businesses, which operate under the guise of legitimacy and hide in plain sight, assist the activities of clandestine brokers and financial firms, leaving a trail of disillusioned investors in their wake.

The time has come for a thorough probe into HLK Group’s operations and its ties to questionable financial players. Only through transparency and strict regulatory scrutiny can we hope to keep investors safe from these schemes. The light of truth must be brought to bear in the shadows, where fortunes are created and lost.

This new evidence is a significant step forward in our quest to identify the masterminds behind this intricate financial fraud. We urge authorities and regulatory organizations to take prompt and decisive action against individuals guilty of this vast fraud as we continue to peel back the layers of deception. The victims deserve justice, and it is our responsibility to hold the criminals accountable for their actions.